The Central Bank of India (CBI), through its Human Capital Management Department, is inviting proposals from reputable training institutes and universities for empanelment to provide an initial training program and a Post-Graduate Diploma in Banking & Finance to candidates.

For Free Updates Click the links to Join our Channels:

Whatsapp Channel | Telegram Channel | Whatsapp Group

The CBI is committed to enhancing the skills and knowledge of its incoming workforce to meet the challenges of an evolving financial landscape. This initiative is part of a broader strategy to maintain high standards of excellence and integrity within the banking industry. The empanelled institutes will be responsible for delivering high-quality education and training to candidates, equipping them with the necessary skills and knowledge for successful careers in banking and finance.

The empaneled institutes/ universities will prepare candidates for absorption into various roles within the bank. This program is designed to comply with directives from the Central Vigilance Commission and prepare trainees for absorption into the banking sector. The experience of bidder may include integrated experience with previous company or previously amalgamated company.

Objective:-

The primary objective of this RFP is to empanel reputable training institutes/ universities that can:

Offer comprehensive training and education to meet the specific needs of the banking sector, ensuring that all trainees are well-prepared for their roles within the bank.

Provide and impart comprehensive training in banking and finance related knowledge.

Offer a PGDBF degree that is recognized and valued in the banking industry.

Ensure high standards of education and training through qualified faculty and state-of-the-art facilities.

Scope of Work:-

The empanelled institutes/ universities will be responsible for:

- Design and deliver a one-year PGDBF program in consultation with the bank.

- Provide a detailed curriculum covering various aspects of banking and finance.

- Ensuring that the course content is up-to-date with current banking regulations and technologies.

- Employing experienced faculty members (minimum 20 permanent members on roll) and guest lecturers from the banking sector.

- Offering state-of-the-art training facilities and resources for atleast 500 candidates at a time.

- Conduct assessments, exams, and evaluations to ensure the quality and effectiveness of the training for atleast 500 candidates at a time.

- Integrate practical and theoretical learning components that reflect the latest trends in banking.

- Offering career support and guidance to ensure successful absorption into the bank.

- Make arrangement for accommodations facility along with safety & security of the candidates for atleast 500 candidates at a time.

- Compliance with all relevant legal and regulatory requirements.

KEY POINTS

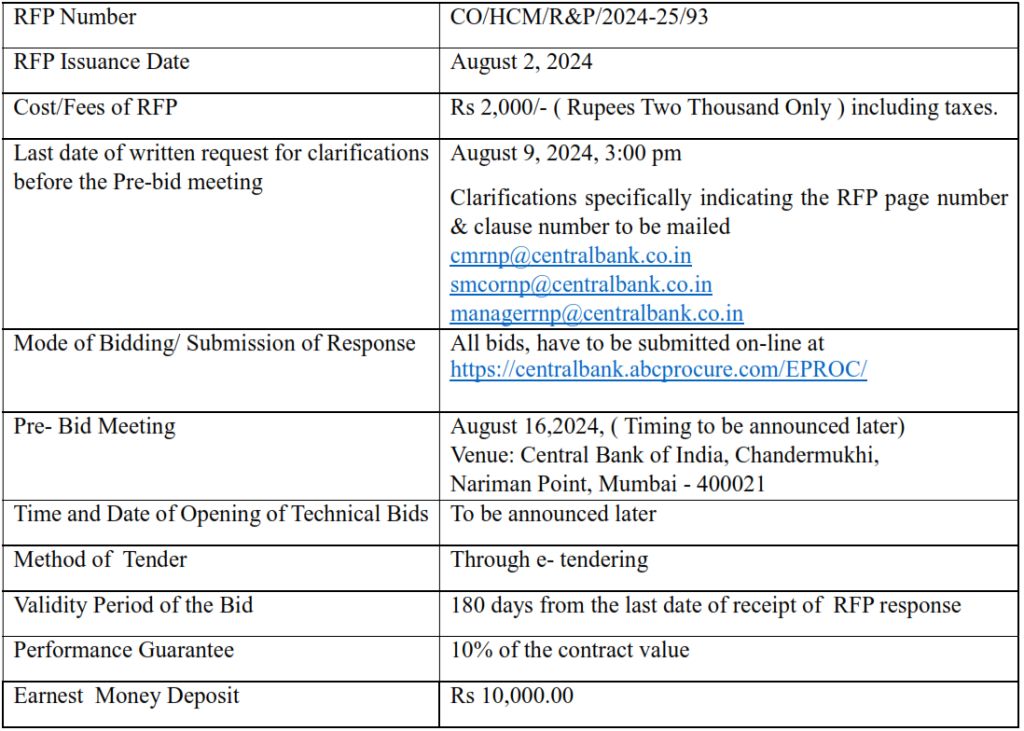

Bid Processing Fee/Application Fee:

Cost of RFP document is INR 2,000/- (Rupees Two Thousand only). While downloading the RFP Document from the Internet (website of Central Bank of India), the prescribed amount towards the cost of Application Document should be paid by the Applicant along with the submission of the Application response. The Cost of RFP / Application document is non-refundable

The RTGS / NEFT details are given below.

Account No: 3288988578 IFSC Code: CBIN0281067

Account Name: CO HRD MPT IRP & RNP Joint AC

RFP document fee is waived off under following considerations:

- In accordance with Government of India guidelines, Micro and Small Enterprises are eligible to get tender documents free of cost and also exempted from payment of earnest money deposit upon submission of copy of valid MSME certificate.

- Start-ups (which are not MSEs) are exempted only from Bid security amount.

Earnest Money Deposit:

1. The Bidders must submit an Earnest Money deposit of INR 10,000 (Rupees Ten Thousand only) along with the submission of the RFP cost.

2. Unsuccessful Bidder’s EMD will be discharged/refunded not later than 30 days from the date of empanelment of successful bidder.

3. The successful Bidder’s EMD will be discharged only after signing of the contract papers.

4. MSME firms are exempted from submitting the EMD on production of the MSME certificate.

5. The EMD shall be forfeited in the following:

a. If a bidder withdraws the bid after the final date or during the period of Bid Validity.

b. Or in case of a successful Bidder, if the Bidder fails to accept the engagement offer.

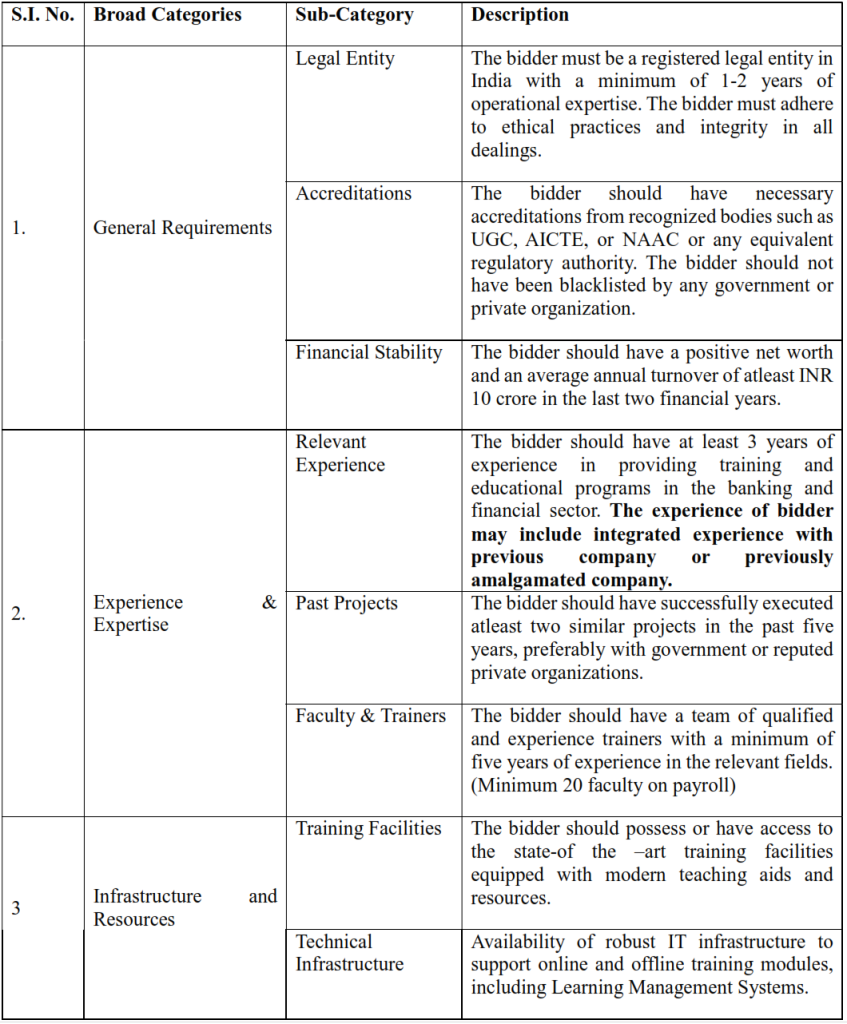

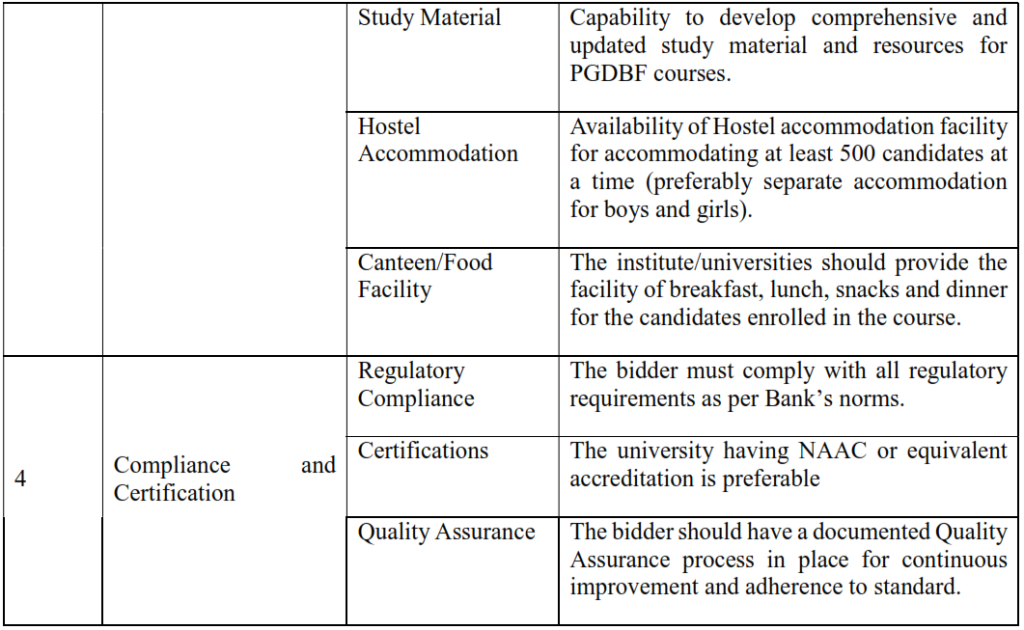

Eligibility Criteria for the Bidder:

The following eligibility criteria will be applied to short-list the bidders for technical evaluation:-

For detailed information on RFP, click the below button to Download: